Spring is traditionally the time when the real estate market heats up. Considering how inventory has remained extremely low during the winter months, many buyers were “out of the market.” That is about to change.

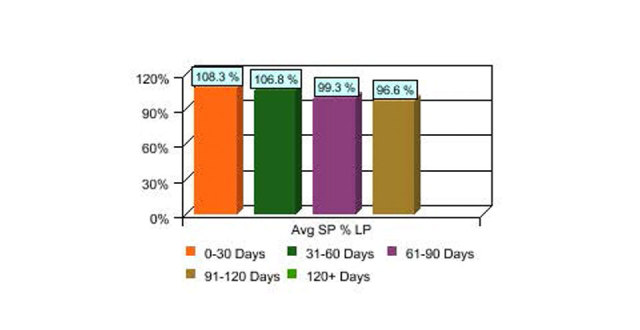

In anticipation of the increase in the number of buyers out searching for a home, it is more important than ever to understand what to expect in terms of multiple offers and over-asking sales prices. Taking a look at what happened last year with “days on market” and “listing price to sales price” alone will not give you the answer for making a successful offer. (See the 2014 quarterly chart, above right.) However, it may help adjust your expectations and move you past a stage or two of irritation or disappointment when you make an offer and it is not accepted by the seller. Wishful thinking will slow down the process of buying a home in San Francisco.

It will be easier to be successful if you accept five simple truths about buying a home in San Francisco.

One: Expect to complete against cash offers. About 40 percent of homes are sold for cash. It is important to remember that when escrow closes, the seller is paid through escrow either directly from the buyer, or from a lender and the buyer. The end result is the same. The buyer gets the house and the seller gets money. Having cash is not the only factor in buying a home.

Two: There will be multiple offers. This does not necessarily mean that other buyers will be offering a higher price, but they may be offering better terms. Last year I had several sales where the agents told me after close of escrow that it was quite remarkable how the offer prices were grouped within a very tight range. The seller accepted my buyer’s offer with the best terms.

Three: You may need to offer more than the asking price. This does not mean you are paying too much! Many agents’ standard marketing plans include an asking price as much as 25 percent under market value.

Four: The seller may set an offer date in as little as seven days after coming on the market. Prepare yourself to make a quick decision about making an offer. This may mean taking time off work to take a second look at the home. You may need to trust your partner in making a final decision if you are traveling for work. Also some fish get away. Not to worry! There will be others.

Five: If you absolutely must be within walking distance to a corporate bus stop or a location like Dolores Park, you can expect to pay 20 percent more than for a comparable home in another location.

Then there are your personal doubts and anxieties about buying a home in San Francisco than must be resolved. These are some of the things buyers think about when they consider buying a home. Don’t be surprised if these are your concerns, too.

One: When the market was down, buyers were concerned they would buy a home and immediately see their investment lose value.

Two: In today’s rising market, buyers are afraid that we are at the top of the market and their investment is in danger. Research from the Association of Bay Area Governments tells us that the rate of increase in price will slow, but there will continue to be a strong demand for housing as the population increases as far out as 2040. Remember that Baby Boomers are living longer and their children want homes of their own.

Three: If interest rates rise slightly, as predicted by the end of the year, this will affect the price of homes.

Four: Multiple offers will cause buyers to pay too much for a home.

Five: Cash buyers rule. It will be impossible to compete against cash.

Six: Making a quick decision to make an offer is too dangerous.

Seven: Paying more for less and living small in San Francisco may not work on the long term.

Eight: Will the mortgage payment leave room in the budget for a life other than owning a home?

Nine: Buyers with children are unsure if they want to send them to school in San Francisco.

Ten: What if a job change requires leaving San Francisco?

There are serious decisions that must be made when buying a home. Given that for most people this is the most important financial decision they will make in their lifetime, this is not surprising. My experience has been that buyers who have discussed their anxieties and feel satisfied with their life plans are more likely to be successful in buying a home whether there are cash buyers, multiple offers, or just a simple sale between one buyer and one seller.

It is important to consider questions that are personal to your situation before you spend time searching for a home. Of course there will be others that come up, but you will be well along the road to making a successful offer and buying a home.